interest tax shield formula

What is the formula for tax shield. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax_shield Interest Tax_rate.

. In the valuation of the interest tax shield it capitalizes the value of the firm and it also limits the tax benefits of the debt. Depreciation Tax Shield Formula Depreciation expense Tax rate. Net Income 8 million 16 million 64 million.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of. Revised Taxable Income is calculated as. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

End Your Tax Nightmare Now. How does interest tax shield affect the value of a company. How is tax shield calculated.

Revised Taxable Income Taxable Income Tax Shield. Tax Shield Formula. Depreciation Tax Shield 2 million 16 million 400k.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Tax rate 35. Interest Tax Shield Interest Expense Tax Rate.

Interest Tax Shield Formula Average debt Cost of debt Tax rate. This means that the Bear will have a taxable income reduced by 8750 and 9800 thanks to the tax. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Interest expenses are considered to be tax-deductible so tax shields are very important as firms can get benefits from the structuring of such arrangements. Calculating the tax shield can be simplified by using this formula. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Learn Tax Consultant Certification - Best Tax Consulting Training - Free Tax Questions. Tax Shield 19250. The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below Interest Tax Shield Formula Average debt Cost of debt Tax rate The calculation of depreciation tax shield Depreciation Tax Shield The Depreciation Tax Shield is the amount of tax saved as a result of deducting depreciation expense from taxable.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. As such the shield is 8000000 x 10 x 35 280000. This reduces the tax it needs to pay by 280000.

Thus the adjusted present value is 115000 or 100000 15000. Tax Shield formula. The formula for calculating the interest tax shield is as follows.

The interest tax shield formula. What is the interest tax shield this company is going to get by using debt. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

This is equivalent to the 800000 interest expense multiplied by 35. The good news is that there is not a lot of calculations to do. Its 50000 debt load has an interest tax shield of 15000 or 50000 30 7 7.

Tax Shield 5000 40000 10000 35. In Scenario B the taxes recorded for book purposes is 400k lower than under Scenario A reflecting the depreciation tax shield. Ad Owe the IRS.

The interest tax shield is positive when the EBIT is. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. So for instance if you have 1000 in mortgage interest and your tax rate is 24.

The tax shield arises from the deductibility of interest paid and increases the value for shareholders. Tax Shield Amount of tax-deductible expense x Tax rate. TaxInterest is the standard that helps you calculate the correct amounts.

In this video on Tax Shield we are going to learn what is tax shield. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Taxes 8 million 20 16 million.

Ad No Money To Pay IRS Back Tax. In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example. The Difference Between APV and.

You May Qualify for an IRS Forgiveness Program. Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. Interest Tax Shield Formula. A suitably quantified value of the interest tax shield increases the value of the business and thus the shareholder value.

The interest tax shield can be calculated by multiplying the interest amount by the tax rate. You would simply multiply the 25000 by 35 to get 8750 for the year 2020 and the 28000 by 35 to get 9800 for the year 2021. Reduce Your Back Taxes With Our Experts.

Interest Tax Shield Interest Expense x Tax Rate Thereby the APV approach allows us to see whether adding more debt results in a tangible increase or decrease in value as well as enables us to quantify the effects of debt. If you wish to calculate tax shield value manually you should use the formula below. Tax Shield Value of Tax Deductible-Expense x Tax Rate.

Tax Shield is calculated as. Interest Expense 20000.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shields Financial Expenses And Losses Carried Forward

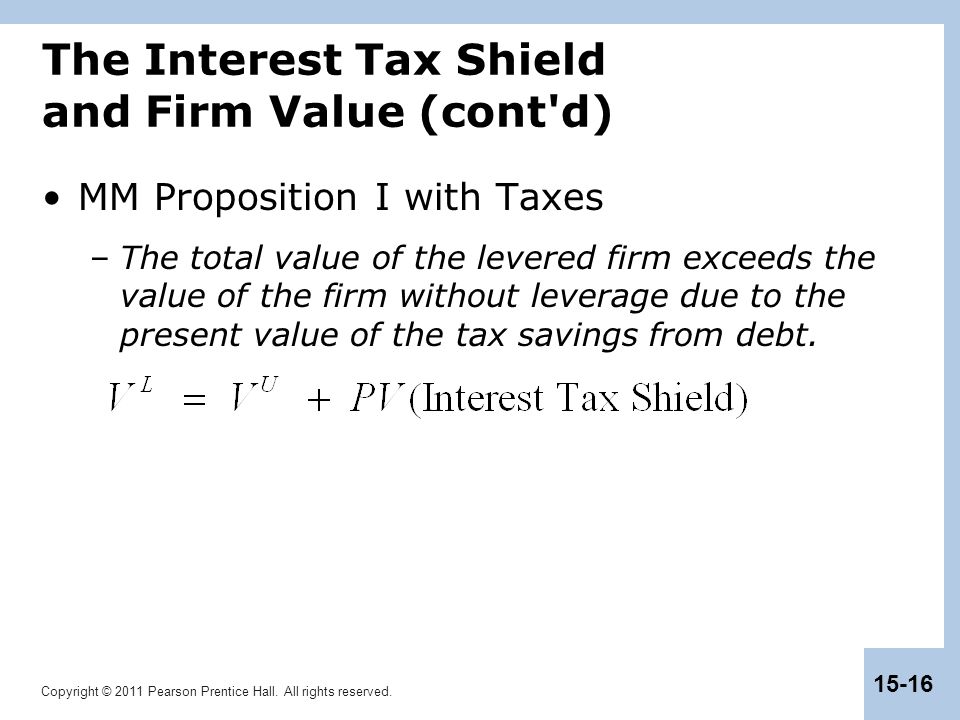

Chapter 15 Debt And Taxes Ppt Download

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example